In the last few years, the payment industry has been experiencing a lot of investments, especially in the African tech ecosystem. The best part about this all is the fact that it does not feel congested in any way as there seems to be a niche market/product fit for them all. In 2019 a total of $2.02 billion in equity was raised in the African tech space alone according to this article by Tech Cabal which is one of Africa's top tech media houses. Majority of these investments went to payments companies.

While it may seem like the problem of payment in Africa has been solved, the global pandemic in 2020 proved that there is still a lot more work to be done in the payment sector. This was particularly exposed due to the COVID-19 pandemic, when people had to adjust their lifestyles to be able to survive. This first affected how people interacted with each other, then proceeded to affect businesses and the many ways they conducted businesses with their customers. When the COVID-19 lockdown was imposed, local businesses and workers providing essential services had to figure out a way to get paid for goods and services rendered. This gave reasons for a lot of businesses to adopt digital payment methods.

Having been in the payment industry for some time, I decided to share what I’ve learned in this article which I’m theming a Starter pack for people designing products in the payment space. This article explores what it means to design for payments especially if it is for the African market.

Topics we will be exploring include the following:

Understanding the problem to be solved

Technology infrastructure

Mobile-first approach

Regulatory compliance

Security

Third-party integrations

Understanding the problem to be solved

Business goals aside understanding the problem to be solved starts with sticky note and sauce to soak up some questions like “how are customers currently navigating their way around this problem?" or "What is the simplest way to solve this problem?" and working your way from there to the solution.

Technology infrastructure

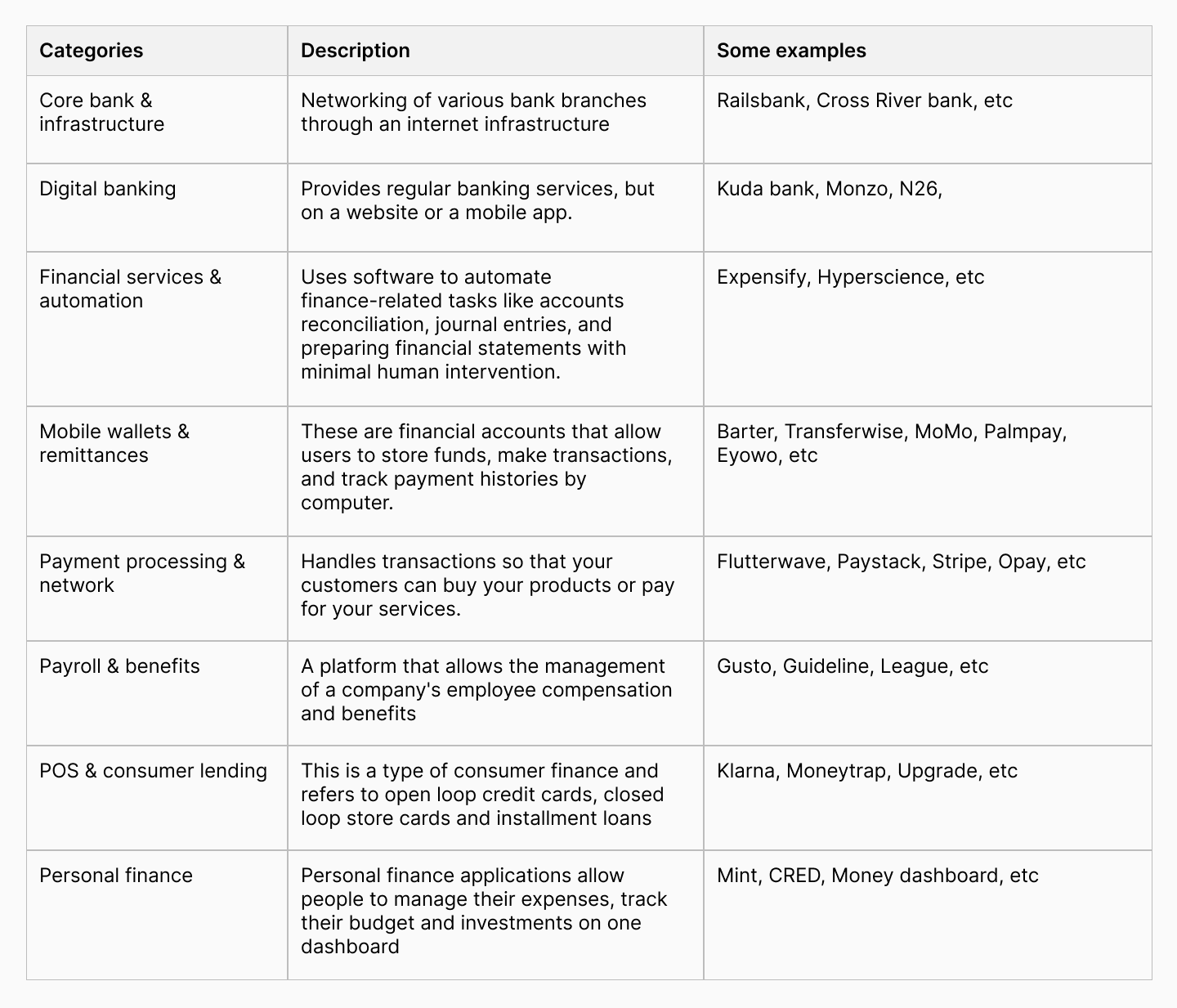

Not all Fintech companies offer the same services. Some are digital banks, mobile wallets, virtual card providers, while others build core infrastructure for some of your favorites banks. The chart below explains the main categories in which Fintech companies are categorized as:

Oftentimes, a business may specialize in more than one category either as product features or as a separate product owned by the company. Either way, designing the ultimate experience for each of these companies is dependent on understanding the psychology behind the decisions made by customers and the technology infrastructure.

Designing the ultimate payment experience is dependent on understanding the psychology behind the decision made by the customers and the technology infrastructure.

An example is that designing for mobile means taking into consideration that the product should be accessible within a mobile browser especially if your target audience is in regions with faux 4G cellular network or internet services are not readily available.Also, the manufacturing year/device capabilities of most of the mobile devices used by the customers need to be taken into consideration as this can influence how the product is experienced by customers. Being aware of these factors will allow the designer to know how to super-serve the core niche of their customers, or figure out how most of their customers like to sort their virtual cards especially if they have multiple cards.

Mobile-first approach

This particular factor does not apply to all of the categories. For example, working in a core bank infrastructure type of Fintech company, you would never have to worry about how your users will experience the product on mobile devices because core bank infrastructure is mostly a backend/API integration. A payment processing company will need to be deliberate about improving their product experience on mobile. Answers will be needed to questions like:

How will this checkout modal look after integration?

What happens if a customer tries to use our product on a different mobile browser that is not chrome?

How should our table columns behave when viewed on smaller screens, can customers still filter results?

Dashboard designs require a high level of visual hierarchy of information representation, so the people using them do not have to constantly contact customer support for every task they want to carry out. This becomes even more critical and more of a heavy task on mobile devices. as having to make it responsive without losing out on accessibility and experience. This is due to the constraint of screen real estate and visual hierarchy which should still be consistent with desktop. Mobile-first also means figuring out how micro-interactions will work because it is easier to use hover effects on the desktop to highlight more information or a tooltip but how will this work on mobile. Finally, when carrying out usability tests for the mobile version of your designs, only conduct this test on actual mobile devices, and not mobile induced environments on the web. Testing on mobile devices puts your design solution in the right context where you get to see how various screen sizes, device specs, and networks influence the experience of the product.

Regulatory compliance

This is the process that banks and payment companies go through to verify that the customers are who they say they are. When designing a compliance flow, you will find yourself constantly trying to establish a balance between making the process to become too secure or giving it the most pleasant experience. Either way, this is all dependent on the regulatory policies you’re working with. Because of the role compliance plays while onboarding customers to payment platforms, it is critical to keep checking how new regulatory policies are affecting your flow. Also check if the bad guys (the real bad guys) have discovered loopholes which they could exploit in the security of your platform which could put you in violation of some Anti-Money Laundering (AML) regulations. Some of the factors to figure out when designing a good compliance flow includes:

Grouping the different information required from customers into similar categories to prevent information overload for example personal information, company details, etc.

Determining how much access you want customers to have before and after they have completed the compliance process.

Depending on the required documents needed from customers, you can then figure out how the submitted documents will be verified for authenticity. There are compliance companies that are used to verify documents of this nature.